The rapid evolution of battery electric vehicles in Canada marks a transformative shift in our automotive landscape. From compact urban runabouts to long-range luxury sedans, the Canadian market now offers an unprecedented selection of electric vehicles that cater to diverse consumer needs and preferences. With federal incentives of up to $5,000 and provincial rebates reaching $8,000 in some regions, Canadian businesses and consumers are increasingly embracing zero-emission transportation solutions. The growing charging infrastructure network, spanning coast to coast, has effectively addressed range anxiety while supporting the nation’s commitment to reduce greenhouse gas emissions by 40-45% below 2005 levels by 2030. As global automakers accelerate their electric vehicle programs and Canadian manufacturers retool their facilities for EV production, this comprehensive guide explores the current landscape of available models, emerging technologies, and strategic considerations for businesses navigating the electric mobility revolution.

Popular Battery Electric Vehicles in Canada

Luxury Segment Leaders

In Canada’s luxury electric vehicle segment, several manufacturers have established themselves as leaders through innovative EV battery technology and premium features. Tesla continues to dominate with its Model S and Model X offerings, setting benchmarks for performance and range. The Model S offers up to 637 kilometers of range, making it particularly suitable for Canadian long-distance travel.

Porsche’s Taycan has quickly become a formidable competitor, combining traditional German engineering with electric innovation. Available in several variants, including the Cross Turismo for added versatility, it appeals to luxury buyers seeking both performance and prestige.

Mercedes-Benz’s EQS represents the pinnacle of electric luxury, featuring advanced driver assistance systems and an impressive 56-inch Hyperscreen dashboard. The BMW iX and i7 have also made significant inroads in the Canadian market, offering sophisticated design and cutting-edge technology.

Audi’s e-tron GT and RS e-tron GT provide a compelling blend of performance and luxury, while the Lucid Air, though new to the market, has garnered attention for its exceptional range and premium features. These vehicles typically start at $100,000 CAD and can exceed $200,000 with optional features, targeting affluent environmentally conscious consumers and executive transport services.

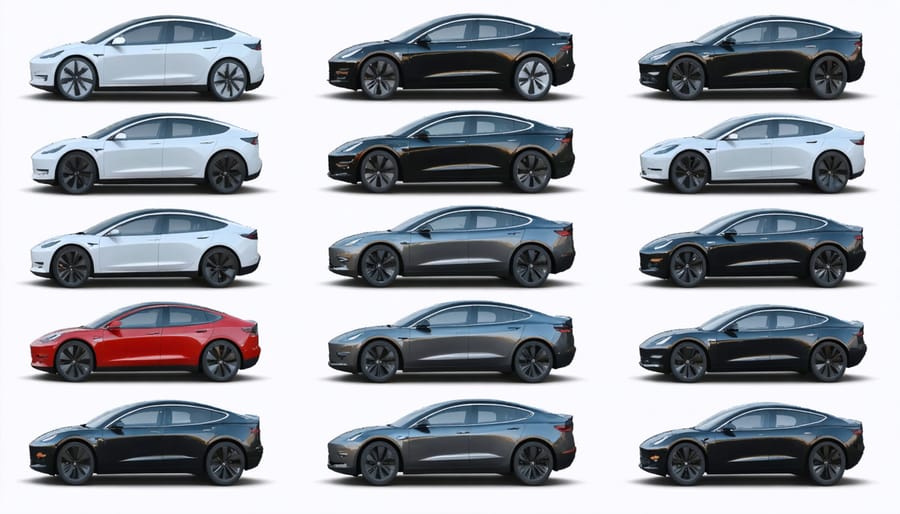

Mass-Market Champions

The mass-market electric vehicle segment has seen remarkable growth, with several models leading the charge in making EVs accessible to everyday consumers. The Tesla Model 3 continues to dominate this category, offering an impressive balance of range, performance, and features at a competitive price point. In Canada, the Model 3 has consistently ranked as the top-selling electric vehicle, particularly in urban centers like Toronto and Vancouver.

The Chevrolet Bolt EV has established itself as a practical and affordable option, particularly appealing to Canadian families seeking value. With its recent price reductions and eligibility for federal and provincial incentives, the Bolt has become increasingly attractive to budget-conscious buyers.

The Hyundai Kona Electric and Kia EV6 have gained significant traction in the Canadian market, offering exceptional range and cold-weather performance – crucial features for our climate. These vehicles have proven particularly popular in Quebec and British Columbia, where robust charging infrastructure and provincial incentives support EV adoption.

The Volkswagen ID.4 has emerged as a strong contender in the mass-market segment, combining German engineering with practical SUV styling. Its all-wheel-drive capability and spacious interior make it well-suited for Canadian driving conditions and lifestyle needs.

According to the Electric Vehicle Council of Canada, these mass-market EVs have contributed significantly to the country’s growing EV adoption rate, with sales increasing by 30% annually since 2020.

Made-in-Canada Electric Success Stories

Local Manufacturing Facilities

Canada’s electric vehicle manufacturing landscape is rapidly revolutionizing Canada’s automotive industry, with significant investments in local production facilities. Ontario leads the charge with major manufacturers establishing EV production lines, including Ford’s Oakville Assembly Complex transformation and General Motors’ CAMI plant in Ingersoll.

The Windsor-Essex region has emerged as a crucial EV manufacturing hub, hosting Stellantis’ $5 billion investment in a state-of-the-art battery facility. This development is expected to create thousands of jobs and strengthen Canada’s position in the global EV supply chain.

Quebec has also secured its place in EV manufacturing, with Lion Electric’s Saint-Jérôme facility producing electric buses and trucks. The province’s rich mineral resources and hydroelectric power make it an ideal location for sustainable vehicle production.

These facilities not only boost local economies but also support Canada’s commitment to zero-emission vehicle targets. Industry experts project that domestic EV production will significantly reduce manufacturing costs and improve vehicle accessibility for Canadian consumers.

Canadian Innovation Highlights

Canadian EV manufacturers have made significant strides in electric vehicle innovation, with companies like Lion Electric leading the way in commercial vehicle electrification. Based in Saint-Jérôme, Quebec, Lion Electric has successfully developed and deployed electric school buses and urban trucks across North America.

NFI Group, through its New Flyer division, has emerged as a major player in zero-emission transit buses, incorporating advanced battery technology and smart charging solutions. Their innovations have been adopted by major cities across Canada and the United States.

Vancouver-based Electra Meccanica has pioneered the development of the SOLO, a single-passenger electric vehicle designed for urban commuting. This unique approach to personal transportation demonstrates Canadian ingenuity in addressing specific market needs.

Nova Scotia’s Dalhousie University has become a global leader in battery research, partnering with Tesla to develop longer-lasting, more efficient batteries. Their breakthrough work in lithium-ion technology continues to influence EV development worldwide.

These achievements showcase Canada’s growing role in the global EV industry, supported by federal and provincial innovation grants and strong collaboration between academic institutions and private sector partners.

Infrastructure and Support

Charging Network Coverage

Canada’s charging network has expanded significantly, with over 16,000 public charging stations now available across the country. Major urban centers like Toronto, Vancouver, and Montreal lead in charging infrastructure density, with new installations occurring monthly. The Canadian government’s Zero Emission Vehicle Infrastructure Program (ZEVIP) has committed $680 million to build 84,500 new chargers by 2027.

Key charging networks like FLO, ChargePoint, and Tesla’s Supercharger network provide extensive coverage along major highways and urban areas. FLO alone operates more than 45,000 charging ports across North America, with a substantial presence in Canadian markets. Recent partnerships between retailers and charging providers have accelerated installation at shopping centers, parking facilities, and workplace locations.

Natural Resources Canada reports that 90% of Canadian drivers now have access to public charging stations within 100 kilometers of their homes. Fast-charging corridors along the Trans-Canada Highway enable coast-to-coast electric vehicle travel, with DC fast chargers typically spaced 50-100 kilometers apart.

Industry experts project the charging network will triple in size by 2025, driven by private investment and government initiatives. Provincial utilities are also playing crucial roles, with BC Hydro and Hydro-Québec leading ambitious expansion projects to support growing EV adoption rates.

Federal and Provincial Incentives

Canada offers substantial incentives to encourage the adoption of battery electric vehicles at both federal and provincial levels. The federal iZEV program provides up to $5,000 for eligible new electric vehicles with a manufacturer’s suggested retail price under $55,000. This incentive has proven effective, with over 100,000 Canadians benefiting since its launch in 2019.

Provincial programs vary significantly across the country. Quebec leads with rebates up to $7,000, while British Columbia offers up to $4,000 through their CleanBC Go Electric program. These can be combined with federal incentives, potentially saving buyers up to $12,000 in some regions.

Several provinces also provide additional perks such as free access to HOV lanes, reduced electricity rates for home charging, and workplace charging installation subsidies. Ontario’s Accelerated Investment Incentive allows businesses to write off up to 100% of EV fleet purchases in the first year.

Municipal governments are increasingly introducing their own incentives, including free parking for EVs, priority parking spots, and charging infrastructure grants. For businesses, many jurisdictions offer tax benefits and grants for installing workplace charging stations and converting commercial fleets to electric vehicles.

To maximize these benefits, buyers should consult their local transportation authority websites, as programs and eligibility criteria are regularly updated to reflect market conditions and policy objectives.

Future Market Outlook

Anticipated New Models

The Canadian electric vehicle market is set to expand significantly in 2024-2025, with several major manufacturers announcing exciting new models. Tesla’s Cybertruck is expected to begin Canadian deliveries in late 2024, while Volkswagen’s ID.7 sedan will arrive in early 2024, offering a compelling alternative in the luxury segment.

Chevrolet is bringing its Equinox EV to market, targeting an accessible price point under $40,000, which experts predict will drive significant adoption among middle-income households. The Polestar 3 SUV is scheduled for Canadian dealerships in mid-2024, featuring advanced autonomous driving capabilities and a range exceeding 500 kilometers.

Canadian startup Project Arrow is developing its first all-electric SUV, showcasing domestic innovation in the automotive sector. The vehicle, set for production in Ontario, demonstrates Canada’s growing role in EV manufacturing.

Several luxury manufacturers are also entering the Canadian market. BMW’s i5 sedan will launch in early 2024, while Mercedes-Benz plans to introduce its EQE SUV. Hyundai’s IONIQ 7 and Kia’s EV9, both three-row SUVs, are generating significant interest among family-oriented buyers.

Industry analysts expect these new models to drive EV adoption rates significantly higher, supported by expanding charging infrastructure and government incentives. According to Electric Mobility Canada, these launches could help push electric vehicle sales to represent 20% of new vehicle purchases by 2025.

For Canadian businesses and fleet operators, this expanded selection offers new opportunities to electrify their operations while benefiting from reduced operating costs and environmental advantages.

Market Growth Predictions

Industry experts predict remarkable growth in the battery electric vehicle (BEV) market over the next decade. According to Bloomberg NEF, global BEV sales are expected to reach 45% of all vehicle sales by 2035, with Canada positioning itself as a key player in developing sustainable transportation solutions.

The Canadian market specifically shows promising indicators, with projections suggesting BEV sales will account for 30% of new vehicle purchases by 2030. This growth is supported by federal and provincial initiatives, including the Zero-Emission Vehicle Infrastructure Program and various consumer incentives.

Major automotive manufacturers are responding to this trend by expanding their BEV offerings in Canada. Companies like GM, Ford, and Tesla have announced significant investments in Canadian operations, strengthening the domestic supply chain and creating new employment opportunities.

Economic forecasts suggest the BEV industry will contribute substantially to Canada’s GDP, with an estimated market value exceeding $43 billion by 2027. This growth is driven by increasing consumer demand, improving battery technology, and declining production costs.

Key growth indicators include:

– Rising consumer acceptance and awareness

– Expanding charging infrastructure networks

– Decreasing battery costs

– Stricter emission regulations

– Corporate fleet electrification commitments

Investment opportunities in the sector continue to multiply, particularly in battery manufacturing, charging infrastructure, and technology development. Industry analysts recommend businesses consider strategic positioning within the BEV supply chain to capitalize on this transformative market shift.

The Canadian battery electric vehicle market has shown remarkable growth and continues to demonstrate strong potential for future expansion. With over 100,000 BEVs now on Canadian roads, the industry has reached a significant milestone in adoption rates. Major manufacturers are increasingly prioritizing the Canadian market, recognizing our commitment to sustainable transportation and robust infrastructure development.

Industry experts project that by 2030, BEVs could represent up to 30% of new vehicle sales in Canada, supported by federal and provincial incentives, expanding charging networks, and growing consumer confidence. Canadian companies like Lion Electric and NFI Group are leading innovation in electric buses and commercial vehicles, positioning Canada as a key player in the global BEV ecosystem.

The foundation for continued growth remains strong, with substantial government investment in charging infrastructure and manufacturing facilities. Several provinces have implemented ambitious targets for BEV adoption, backed by practical support measures for businesses and consumers. The recent establishment of domestic battery manufacturing facilities further strengthens Canada’s position in the BEV supply chain.

As technology advances and prices continue to decrease, BEVs are becoming increasingly accessible to Canadian businesses and consumers. With continued support from all levels of government and growing private sector investment, Canada is well-positioned to be a leader in the global transition to electric mobility, creating new opportunities for economic growth and environmental sustainability.