In today’s rapidly evolving business landscape, identity solutions have become the cornerstone of secure digital transformation in finance and enterprise operations. As Canadian organizations face increasingly sophisticated cyber threats and regulatory requirements, implementing robust identity management systems has shifted from a luxury to a business imperative. Modern identity solutions combine biometric authentication, AI-powered fraud detection, and seamless user experiences to protect sensitive data while streamlining customer interactions and internal processes.

These advanced systems not only safeguard organizations against unauthorized access and identity theft but also drive operational efficiency by automating verification processes, reducing compliance risks, and enabling secure remote access for employees and customers alike. For Canadian businesses navigating the complex intersection of technology, security, and regulatory compliance, understanding and implementing the right identity solution has become crucial for maintaining competitive advantage and building trust in an increasingly digital marketplace.

The Evolution of Business Identity Verification

Traditional vs. Digital Identity Verification

Traditional identity verification methods relied heavily on physical documents, in-person meetings, and manual processing – often resulting in lengthy approval times and increased operational costs. Business owners would typically need to present multiple forms of identification, wait for document verification, and sometimes make repeated visits to financial institutions.

Today’s digital identity solutions have revolutionized this process. Advanced technologies like biometric authentication, AI-powered document verification, and real-time database checks now enable near-instantaneous verification. Canadian businesses can onboard customers remotely while maintaining high security standards through multi-factor authentication and automated fraud detection systems.

According to the Canadian Bankers Association, financial institutions using digital identity verification report up to 80% reduction in processing times and significant cost savings. These modern solutions also provide better protection against identity theft and fraud compared to traditional methods.

The shift to digital verification has been particularly beneficial for Canadian businesses operating in remote areas, as it eliminates geographical barriers while ensuring regulatory compliance with FINTRAC guidelines and privacy laws. This evolution has made financial services more accessible while maintaining the robust security measures necessary in today’s digital economy.

Canadian Regulatory Framework

In Canada, digital identity solutions operate within a robust regulatory framework overseen by multiple authorities. The Personal Information Protection and Electronic Documents Act (PIPEDA) serves as the cornerstone legislation, establishing strict guidelines for collecting, using, and disclosing personal information in commercial activities.

Financial institutions must also comply with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), which requires thorough identity verification processes. The Digital ID & Authentication Council of Canada (DIACC) provides additional guidance through its Pan-Canadian Trust Framework, offering standards for secure and privacy-respecting digital ID solutions.

Provincial regulations add another layer of compliance requirements, with Quebec’s Bill 64 and Ontario’s digital identity initiative leading significant regional developments. The Office of the Privacy Commissioner of Canada actively monitors and enforces these regulations, ensuring organizations maintain appropriate safeguards for identity data.

Canadian businesses implementing identity solutions must demonstrate compliance with these frameworks while maintaining flexibility to adapt to evolving regulatory requirements and technological advances. Regular audits and updates to identity verification processes are essential for maintaining regulatory compliance.

Core Components of Modern Identity Solutions

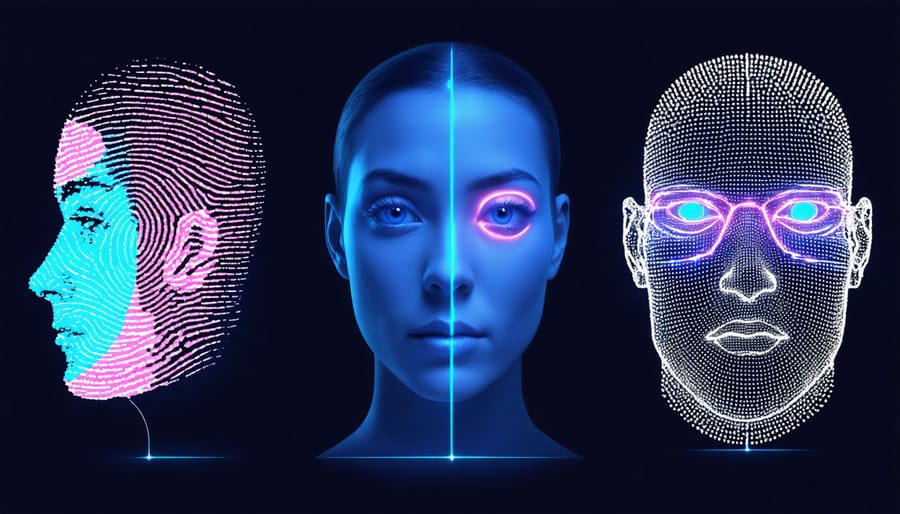

Biometric Authentication

Biometric authentication has emerged as a cornerstone of secure business transactions in Canada’s digital economy. This technology uses unique physical characteristics, such as fingerprints, facial features, or iris patterns, to verify individual identities with unprecedented accuracy.

Canadian businesses increasingly rely on biometric solutions to protect sensitive transactions and maintain customer trust. According to the Canadian Bankers Association, over 70% of major financial institutions have implemented some form of biometric authentication in their security protocols.

Toronto-based financial technology company Sensibill demonstrates the effective use of biometric authentication in their mobile banking solutions. Their implementation of fingerprint and facial recognition has reduced fraud incidents by 45% while improving customer satisfaction rates.

Key benefits for businesses include:

– Enhanced security through multi-factor authentication

– Reduced risk of identity theft and fraud

– Streamlined customer experience

– Compliance with privacy regulations

– Cost-effective long-term security solution

“Biometric authentication provides a perfect balance between security and convenience,” notes Sarah Chen, cybersecurity expert at the Royal Bank of Canada. “It’s becoming an essential tool for businesses that want to protect their digital assets while maintaining operational efficiency.”

For Canadian businesses considering biometric solutions, it’s crucial to select systems that comply with the Personal Information Protection and Electronic Documents Act (PIPEDA) and integrate seamlessly with existing security infrastructure.

Blockchain and Decentralized Identity

Blockchain technology is revolutionizing identity management by offering unprecedented security and control over personal and business information. Through decentralized identity solutions, Canadian businesses can now implement robust blockchain security solutions that protect sensitive data while streamlining verification processes.

Unlike traditional centralized systems, blockchain-based identity management distributes data across a network of nodes, making it virtually impossible for unauthorized parties to manipulate or compromise information. Each transaction or identity verification is recorded in an immutable ledger, creating a transparent and auditable trail of all interactions.

Canadian technology firm SecureKey Technologies demonstrates the potential of blockchain in identity management through their Verified.Me platform, which enables secure identity verification for major Canadian banks and service providers. This innovation has significantly reduced identity fraud while improving customer experience.

The decentralized nature of blockchain puts identity control back in the hands of individuals and organizations. Users can selectively share specific identity attributes without revealing unnecessary personal information, enhancing privacy while maintaining compliance with regulations like PIPEDA.

For businesses, implementing blockchain-based identity solutions offers several advantages:

– Reduced operational costs

– Enhanced security and fraud prevention

– Improved customer trust

– Streamlined compliance procedures

– Faster identity verification processes

As more Canadian organizations adopt this technology, we’re seeing a transformation in how businesses handle identity management and verification.

Business Benefits and ROI

Operational Efficiency Gains

Digital identity solutions significantly streamline business operations by automating traditionally manual processes. Canadian businesses report up to 40% reduction in customer onboarding time when implementing digital identity verification systems. This efficiency translates directly to cost savings and improved customer satisfaction.

By automating identity verification, businesses eliminate paperwork, reduce human error, and accelerate transaction processing. For example, Toronto-based fintech company Vena Solutions achieved a 60% decrease in verification processing time after implementing a digital identity system, allowing their team to focus on higher-value tasks.

“Digital identity solutions have revolutionized how we handle customer verification,” says Sarah Chen, Chief Operations Officer at RBC Digital Banking. “What once took days now takes minutes, significantly improving both operational efficiency and customer experience.”

These solutions also enable seamless integration across different business systems, creating a unified workflow that enhances productivity. From HR onboarding to customer authentication, digital identity platforms provide a single source of truth that reduces redundancy and improves data accuracy.

The adoption of these systems has proven particularly valuable for remote operations, enabling secure authentication and verification processes regardless of physical location. This flexibility has become essential for Canadian businesses adapting to evolving work environments and expanding market reach.

Risk Reduction and Compliance

Identity solutions play a crucial role in reducing organizational risks and ensuring regulatory compliance in today’s digital business environment. By implementing robust risk management frameworks, Canadian businesses can effectively protect sensitive data while meeting stringent regulatory requirements.

These solutions help organizations comply with key regulations such as PIPEDA (Personal Information Protection and Electronic Documents Act) and provincial privacy laws. They provide detailed audit trails, automated compliance reporting, and real-time monitoring capabilities that significantly reduce the risk of data breaches and unauthorized access.

According to the Canadian Centre for Cyber Security, implementing proper identity solutions can reduce security incidents by up to 60%. These systems help prevent fraud through multi-factor authentication, biometric verification, and advanced encryption protocols.

Leading Canadian financial institutions have reported substantial improvements in their compliance scores and reduced audit findings after implementing comprehensive identity solutions. These technologies also help businesses adapt quickly to new regulations and security requirements, ensuring continuous compliance while maintaining operational efficiency.

The automated nature of modern identity solutions reduces human error in compliance processes, leading to more reliable security measures and better protection of sensitive customer information.

Implementation Success Stories

Financial Institution Case Study

In 2021, one of Canada’s leading financial institutions faced significant challenges with customer onboarding, experiencing high drop-off rates and lengthy verification processes that averaged 24 minutes per customer. The bank partnered with a Toronto-based identity verification provider to implement a comprehensive digital identity solution across their retail banking operations.

The new system introduced AI-powered document verification and biometric authentication, allowing customers to verify their identity through their mobile devices in under three minutes. The solution integrated seamlessly with the bank’s existing mobile app and core banking systems while maintaining compliance with FINTRAC regulations and privacy laws.

Results were impressive within the first six months of implementation. Customer onboarding completion rates increased by 35%, while verification processing times decreased by 87%. The bank reported a 42% reduction in fraud attempts and achieved annual cost savings of $3.2 million by reducing manual verification processes.

“This transformation wasn’t just about efficiency,” notes Sarah Chen, the bank’s Chief Digital Officer. “It was about creating a secure, frictionless experience that met our customers’ expectations for modern banking while maintaining the highest standards of security and compliance.”

The success of this implementation has set a new standard for digital identity verification in Canadian banking, with several other financial institutions now following suit.

SME Integration Success

When Toronto-based accounting firm McKenzie & Associates faced mounting challenges with client identity verification, they turned to a modern digital identity solution that transformed their business operations. The firm’s journey towards digital adoption for SMEs showcases how small businesses can successfully implement identity verification technology.

“We reduced our client onboarding time from three days to just 30 minutes,” explains Sarah McKenzie, the firm’s founder. “More importantly, our compliance confidence increased significantly, and we’ve eliminated paper-based verification entirely.”

The implementation process took just six weeks, with minimal disruption to daily operations. The firm utilized a cloud-based identity verification platform that integrated seamlessly with their existing accounting software. The solution’s AI-powered document verification and biometric matching capabilities helped them meet FINTRAC requirements while improving client satisfaction.

The results were remarkable: a 40% reduction in operational costs, zero reported identity fraud incidents, and a 95% client satisfaction rate. The firm also experienced a 30% increase in new client acquisition, as businesses appreciated the streamlined onboarding process.

McKenzie’s success demonstrates how identity solutions can be particularly effective for small businesses, providing enterprise-level security and efficiency at a scale that makes sense for SMEs. Their experience has become a model for other Canadian professional services firms looking to modernize their identity verification processes.

Future-Proofing Your Business

As businesses evolve in an increasingly digital landscape, implementing a robust identity solution isn’t just about addressing current needs—it’s about preparing for future challenges and opportunities. Leading Canadian organizations are adopting scalable platforms that can adapt to emerging technologies and changing regulatory requirements.

A key aspect of future-proofing is selecting solutions with flexible architecture that can integrate with new authentication methods as they emerge. This includes accommodating biometric innovations, blockchain-based identities, and advanced AI-driven verification systems. According to the Canadian Digital Identity Council, businesses that invest in adaptable identity infrastructure are 60% more likely to successfully navigate digital transformation initiatives.

Consider implementing a modular approach that allows you to add or modify features without overhauling your entire system. This strategy has proven successful for companies like Toronto-based Maple Financial, which seamlessly integrated new verification methods while maintaining existing security protocols.

Pay attention to international standards and compliance frameworks. As global digital identity regulations evolve, choosing solutions that align with international standards ensures long-term viability and cross-border operations capability. The Pan-Canadian Trust Framework provides an excellent foundation for this approach.

Investment in staff training and regular system updates is crucial. Create a dedicated team responsible for monitoring industry trends and assessing new security threats. Regular audits and penetration testing help identify potential vulnerabilities before they become problems.

Finally, maintain strong relationships with identity solution providers who demonstrate a commitment to innovation and ongoing support. This partnership approach ensures your business stays ahead of identity management challenges while maximizing return on investment.

Identity solutions have become indispensable for Canadian businesses looking to thrive in today’s digital economy. By implementing robust identity management systems, organizations can enhance security, streamline operations, and build trust with customers. The benefits of reduced fraud, improved compliance, and enhanced customer experience make identity solutions a strategic investment worth considering.

As technology continues to evolve, businesses that embrace these solutions position themselves for sustained growth and success. Whether you’re a startup or an established enterprise, the time to act is now. Consider consulting with identity solution providers, assessing your current systems, and developing an implementation strategy that aligns with your business goals. By taking these steps, you’ll be better equipped to protect your assets, serve your customers, and compete effectively in an increasingly digital marketplace.

Take the initiative to secure your business’s future with a comprehensive identity solution today.